5-minute read

Hey girlies! Back again to talk all things credit — but this time, we’re tackling something that can feel like it was written in another language: credit card statements.

I know, I know… your statement lands in your inbox or mailbox and you either:

- Ignore it because ugh, adulting 😩, or

- Scroll through, wondering what even is all this?! 🤷🏽♀️

Fun fact: this topic came straight from one of you! And I love that because I want to write about what YOU care about. Let’s dive in and decode that mysterious sheet of numbers.

First things first: What is a credit card statement?

Think of it as your monthly report card for your credit card. It shows:

- Everything you bought 🛍️

- How much you owe 💰

- Fees & interest (if any) 🫠

- Your payment deadline ⏳

If you’ve gone paperless, you’ll get an email that says, “Your statement is ready.” Please, for the love of your credit score, open it. Banks legally have to send it at least 21 days before your payment is due, so you’ve got time to plan.

Meet Sarah 💁🏽♀️

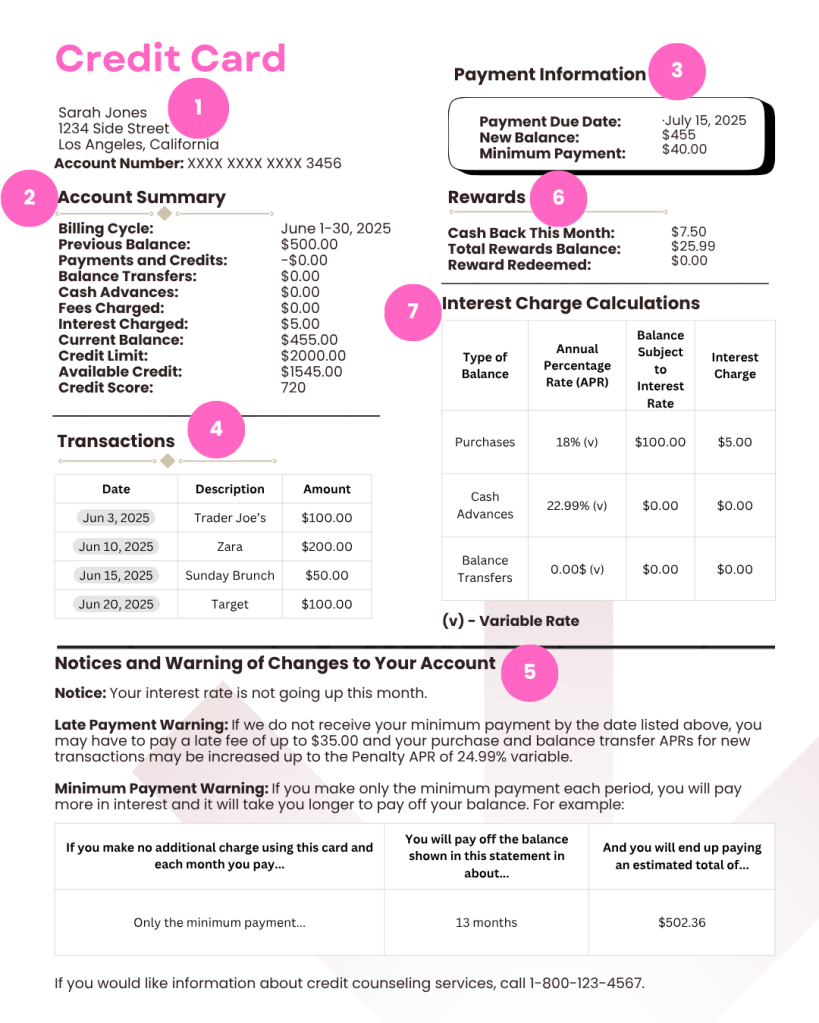

Sarah’s a 25-year-old designer who uses her card for groceries, brunch, and “I deserve this” matcha. Let’s break down her statement step by step:

1. Account Info 🪪

The “name tag” of her statement — her name, the last 4 digits of her card, and her address.

💡 Why it matters: Make sure your name and account number are correct. If not, call your card issuer ASAP — you don’t want someone else’s charges on YOUR record.

2. Account Summary 📊

The big picture snapshot:

- Billing Cycle – Her “money month,” which doesn’t always match the calendar month

- Example: this means only purchases, payments, fees, or interest from June 1–30 show here. If she bought something July 1? That’s next month’s statement.

- Previous Balance – What she owed last month. FYI she’s paying interest on this.

- Payments & Credits – Money she paid or refunds she got.

- New/Statement Balance – What she owes this month (Pay this in full = no interest 🙌).

- Fees – Late fees, annual fees, over-limit fees, foreign transaction fees — basically, money she didn’t plan to spend.

- Interest Charged – Since she didn’t pay her credit card in full last month, this is how much it cost her.

- Credit Limit – The maximum amount her bank will let her borrow on this card.

- Available Credit – Her limit minus what she already spent.

- Credit Score – Some banks include it; it’s her FICO score.

💡 Why it matters: This is your quick health check — it shows how much space you have left on your card and gives you a snapshot of your financial behavior.

3. Payment Info 💸

Where you find:

- Minimum Payment Due – The smallest amount Sarah can pay to avoid late fees (but always try to pay more).

- Due Date – Her minimum payment must be made on or before this date. If not, she’ll get hit with late fees.

💡 Why it matters: Paying late = fees + possible penalty interest rate. Paying just the minimum = debt that sticks around like a bad situationship.

4. Transactions 🛍️

Every purchase, refund, or fee with date, vendor, and amount.

She should look out for:

- Charges she doesn’t recognize 👀 (could be fraud)

- Weird vendor names (Google them — it might just be the company’s legal name)

💡 Why it matters: This is where you catch mistakes before they snowball into bigger problems.

5. Notices & Warnings ⚠️

If her interest rate’s about to go up or new fees are coming, she’ll see it here.

📉 Minimum Payment Warning – This box shows how long it’ll take for her to pay off what she owes this month if she only pays the minimum. Spoiler: basically forever.

Late Payment Warning – This is her card company basically saying, “Pay on time or we’re coming for your coins.”

Notice of Changes – Interest rates going up? New fees? They legally have to tell you.

💡 Why it matters: By law, they have to give you 45 days’ notice before changes kick in — so don’t skip this section.

6. Interest Charges 📉

Since Sarah carried a balance, this is where they tell her exactly how much it cost her.

- Sarah’s Purchase Annual Percentage Rate (APR): 18% per year (0.0493% per day)

- Since Sarah left $100 unpaid from last month:

- $100 × 0.000493 × 30 days ≈ $1.48 interest

- Plus ~$3.52 interest on some new purchases before she paid

- Total Interest: $5.00

- Variable Rates: Credit card companies can change APR, like rent after your lease ends.

💡 Why it matters: Interest is sneaky. Even small balances cost you money.

7. Rewards Summary 🎁 (for my points & cash-back girlies)

Shows:

- Points or cash back she earned this cycle

- Rewards redeemed (aka what she spent)

- Her total rewards balance

💡 Why it matters: Rewards are only valuable if you actually use them before they expire.

What Sarah Should Do ✅

- Pay in Full/Pay More Than the Minimum — Paying the full $455 means no more interest next month.

- Spending Habits – See exactly where her money’s going.

- Look at Fee & Rate Changes – She can stay ahead so she’s not blindsided by higher interest rates.

- Set a Reminder — July 12 in her phone to pay before the due date.

- Check for Fraud — All good this time.

- Set alerts for big purchases or low balances.

- Use Rewards Wisely — Apply the $25 to her bill or let it grow.

Bottom line

Your credit card statement isn’t just a bill — it’s your financial cheat sheet. Read it, understand it, and you’ll never be caught off guard by fees, interest, or surprise charges. So, girlies — are you team “I read my statement” or team “I just pay and pray”? Drop your answer in the comments.

Until next time,

Your fave finance girlie 💖

Leave a comment